The repayment of student loans can be expensive, demanding, and hard. Whether you secured student loans to pay for college or a personal K–12 schools, the repayment of student loans depends on various factors.

Factors like interest rates, loan debt consolidation, and the repayment of your student loan debt will be covered in this blog. We’ll also speak about some other things you can do to handle your loans. Reading this blog can help you make crucial choices about your loan repayment.

Factors That Affect Your Student Loan Repayment

Your Loan’s Interest Rate

The interest rate informs you how much you will need to repay on top of the quantity you obtained. More of your regular monthly payment will go towards paying off the interest.

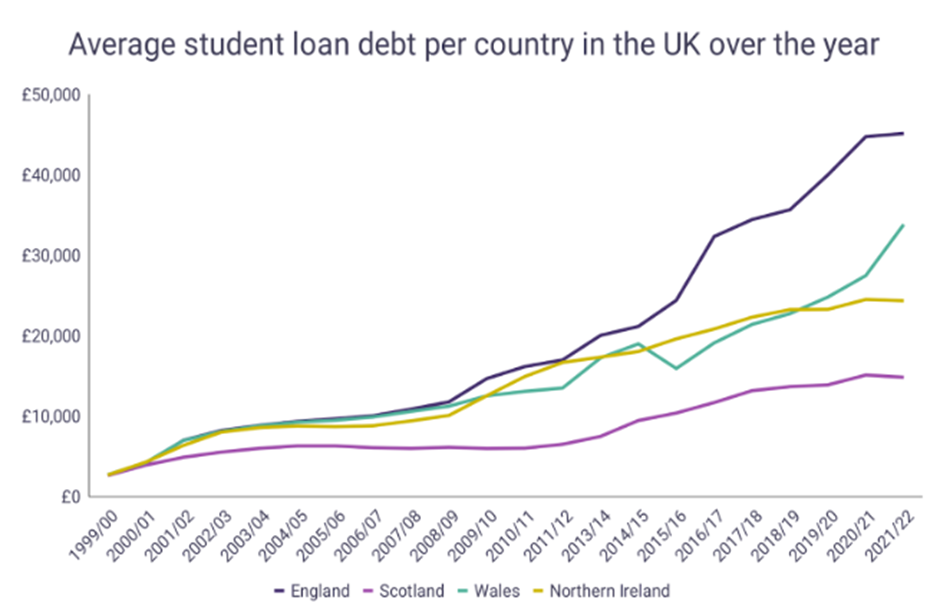

The average student starting university this year is expected to graduate with a student loan debt of £45,800.

It is really essential to understand how the interest rate on your loan impacts your repayment strategy. You may want to pay off the ones with the highest interest rates initially if you have a number of loans with various interest rates. Focusing on these loans with high-interest rates allows you to pay less interest with time.

Obtaining debt consolidation loans with bad credit on guaranteed approval from direct lenders can be a valuable solution for paying off your student loan and reducing interest rates and loan terms.

Guaranteed approval options provide a ray of hope for individuals with less-than-perfect credit histories, allowing them to consolidate their debts into a single manageable loan.

Doing so can potentially secure a lower interest rate, enabling you to save money and repay your loan more efficiently. Consolidation also allows you to streamline your repayment process by combining multiple payments into one.

For efficient loan repayment strategies, you need to understand the interest rate on your student loan. You can make wise choices about how to decrease your debt and how to obtain money if you understand how this impacts your basic debt load. Every pound you save on interest gets you one step forward to paying off your student loans.

According to the latest statistics, the value of outstanding student loans reached £206 billion at the end of March 2023, and it is expected to grow to £460 billion by the mid-2040s. The average student loan debt in the UK is about £35,000, which is close to double the amount a typical American graduate owes. Student loan interest rates are around 1.75%, and repayment starts when the debt holder earns around £25,000 per year.

Your Loan Term

The length of your loan term is an essential aspect to repaying your student loans. A much shorter loan term might indicate higher monthly payments but less money paid in interest.

Example Loan Repayment Scenarios:

| Loan Amount (£) | Interest Rate | Loan Term | Monthly Payment (£) |

| £20,000 | 5% | 10 years | £169.70 |

| £40,000 | 6% | 20 years | £234.89 |

| £60,000 | 7% | 30 years | £319.54 |

Before selecting a loan term, offer yourself a long time to think of your objectives and funds. You may want to select a much shorter loan term if you have a constant income and can manage higher monthly payments.

Your Repayment Plan

Your repayment plan informs you about your monthly payment and the length of time. Select a plan that fits your objectives and how much money you have.

There are numerous repayment options with different guidelines. The most typical option is the regular repayment strategy, in which you pay a set quantity monthly for 10 years. This strategy will help you settle your loan in a sensible quantity of time. However, your regular monthly payments might be more outstanding.

The total student loan debt in England is expected to be £460 billion by 2046.

It’s crucial to take a look at each repayment strategy thoroughly and think of things. Things like your present income, how much you might make in the future, and other financial responsibilities. Bear in mind that picking the ideal repayment strategy can affect your other financial objectives.

Student Loan Repayment Plans

| Repayment Plan | Monthly Payment | Loan Forgiveness Eligibility |

| Standard Repayment | Fixed amount | Not eligible |

| Graduated Repayment | Lower at first, then increases over time | Not eligible |

| Income-Driven Repayment (IDR) Plans: | ||

| – Income-Based Repayment (IBR) | 10% – 15% of discretionary income | After 20 or 25 years of qualifying payments |

| – Pay As You Earn (PAYE) | 10% of discretionary income | After 20 years of qualifying payments |

| – Revised Pay As You Earn (REPAYE) | 10% of discretionary income | After 20 or 25 years of qualifying payments |

| – Income-Contingent Repayment (ICR) | 20% of discretionary income or a fixed amount over 12 years | After 25 years of qualifying payments |

Your Income

Your monthly income also affects your loan repayment. It impacts not how much you can put down. It also impacts your total financial security and how open you can be with your loan.

You may be able to contribute more money to student loan repayment without getting too stressed out about money if your income is much better. It might be tough to pay higher regular monthly bills. In these cases, it’s essential to check out other repayment options that are more inexpensive for your income level.

Your income can impact whether or not you are certified for particular loan waivers or loan repayment plans. Some plans take a look at your income to see if you receive small regular monthly payments and even complete loan forgiveness after a particular quantity of time.

Source: wordsrated

Your Family Size

Your regular monthly loan repayment quantity might be affected by the variety of individuals residing in your home.

You most likely have more requirements and jobs that cost money if you have a huge family. You may have less money for student loan repayment as a result. With a small family, you might have more flexibility in settling your loans.

Having a family can also make it harder for you to enter into some loan repayment plans or pick choices for getting your loans cancelled. If you have taken loans for students with bad credit, then there is a chance that you might have gotten that loan with high-interest rates. So if this is the case and you have a big family to serve, ask your lender to reduce the rates.

Conclusion

There are a lot of aspects that can affect your student loan repayment. Learning about the various elements and making strategies based on your own circumstance is essential. Put your student loan payments in order of value, make numerous payments, and duplicate your loans to attain student loan repayment success.

It boils down to being familiar with and experienced with your own money and choosing plans that can set you up for success in the future. You can pay off your student loans efficiently and regularly if you have the ideal understanding.

Jessica Rodz is the Senior Content Writer at Cashfacts. She has a long career in the field of content writing and editing. Jessica has the expertise in the UK lending marketplace where she has worked with 7 different lending organisations and acquired many responsibilities from preparing loan deals and writing blogs for their websites.

At Cashfacts, Jessica is managing a team of experienced loan experts and doing a major contribution in guiding the loan seekers via well-researched blogs. She has done graduation in Business (Finance) and now currently doing research papers on the UK financial sector.