Generally, when you need urgent money, you search for the best payday loans around. It helps you get instant cash and pay when your salary gets credited. The process may be a breeze. However, some circumstances may not meet the payday loan requirements. What if you need urgent money without a bank account? What if you need cash at home despite bad credit?

Here, a doorstep loan may be the solution. It helps you get the money home without a bank account or even a credit score. You get the cash delivered to your home/office the same day, within 45 minutes. Easy process, no collateral, and no guarantor requirement make it popular among individuals. However, is it right for you, too? Let’s read about doorstep loans in detail.

How would you define doorstep loans in simple terms?

Doorstep loans are an unsecured and quick loan facility for individuals and businesses. It is different from other fast loans as you can get one even without a valid bank account. However, having one eases the process.

It is ideal for students or non-EU students needing urgent cash. Alternatively, employees and pensioners may also check it for critical needs. One may qualify just by providing proof of basic income, like a salary slip, pension statement, etc.

The interest rates on these loans remain competitive. It is higher than that of a payday loan. It is due to the facility and comfort it offers. You can use the loan for any purpose, like paying the utility bill, getting cash for urgent repairs, or dealing with a medical emergency. You can also use it in the event that your card does not work.

Is a doorstep loan visible on a credit report?

According to MoneyHelper, doorstep loans are visible on the credit report. However, not every lender reports unpaid doorstep loans. If the creditor does, then the missed payments may be visible on the credit report.

It may slightly affect your ability to get affordable finance solutions. However, it is a rare case. Most individuals prefer doorstep loans because of the ease they offer. For example, your credit score remains the same even after the initial credit screening. Why?

This is because you may get doorstep loans with no credit checks from a direct lender in the country. This means that the loan provider only conducts a basic check that does not affect your credit score. However, no responsible loan provider provides a loan without a basic credit assessment or a credit check. It may hamper the borrower’s and lender’s financial interests.

How do doorstep loans work?

Doorstep loans are an instant cash facility where you can get the cash delivered to your home on the same day. It is a type of home credit where the final proceedings take place face-to-face. You don’t need to go anywhere. Instead, the lender’s representative will reach your home after your initial online application.

It thus ensures the door-to-door service that adds to the convenience. You can get only £1100 for your needs on doorstep loans. It is strictly for small and emergency purposes. You don’t need to worry if you lack an ideal credit score.

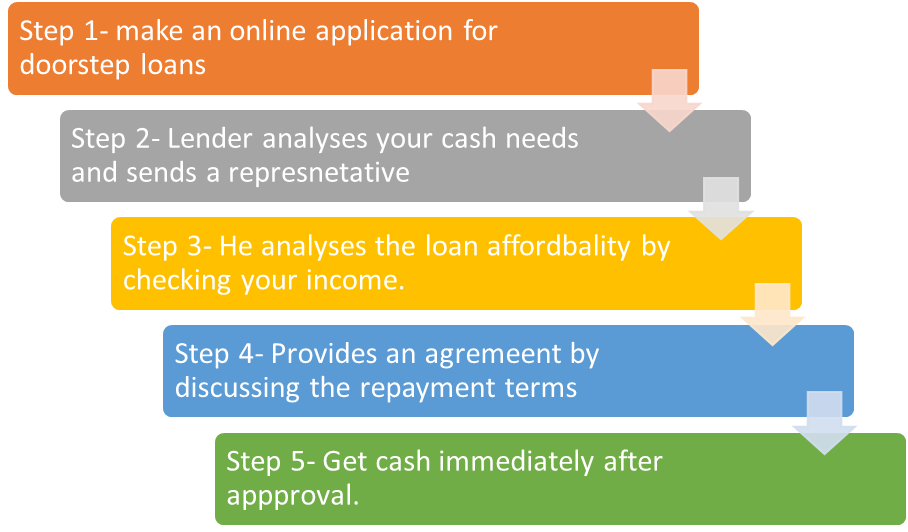

You may get very bad credit loans from direct lenders with no credit check facility. A low credit history does not stop you from qualifying. It is unless you hold proof of powerful repayment. You may qualify if you can repay the dues by the end of the loan term. It is the basic rule of doorstep loans. Thus, don’t let your poor credit rating affect your current cash needs. Get the doorstep loans by following these 5 simple steps:

Let’s discuss this in detail. Here is how the doorstep loan work:

Step 1- Fill in the application

Identify the cash needs and apply online. Check the basic costs using a loan calculator before applying. It will help you deal with the right provider that aligns with your budget. Cross-check the information like- name, email ID, home address (if asked), contact number, and amount needed. Check for spelling errors. Choose the purpose or write manually if not provided. Click “Apply.”

Step 2- The lender analyses the application

Soon after your application, you may receive an email or call regarding the doorstep loans. Here, the responsible loan provider confirms your need for the loan. Accordingly, he sends one of his representatives to help you with further proceedings at your mentioned address. Always cross-check the profile from the company and agent before believing the agent. It helps you avoid fraud and deal with authentic loan providers.

Step 3- Lender’s agent conducts further checks

The lender’s representative shares expertise in screening the profiles. He may help you choose the right amount for your needs. Thus, he analyses your requirements and demands for proof of affordability. It is essential for the agent to know whether you can repay the loan comfortably. Your income should be higher than the amount requested. It helps you qualify instantly. Always provide the latest salary slip, driving license, or passport as proof of identity. You can even provide a utility bill as address proof (if asked).

Step 4- Provide a basic loan agreement

The agent verifies your details and match it with authentic proofs. Next, he provides the basic loan agreement after discussing the payment terms. You can choose a shorter or a longer repayment term according to your income and liabilities. Individuals with seasonal or low pay may repay the dues in 12 months. Alternatively, you can choose to repay the dues within 3-6 months.

No reliable loan provider may force you into accepting a particular repayment tenure. Instead, you share 100% dominance over choosing the repayment term. Analyse the conditions in detail. Enquire about anything you are not sure about.

Step 5- Get cash immediately after providing consent

After creating the agreement, you get some time to improvise on the terms and payments. Check the costs, such as APR, interest rates, total repayment amount, etc. Analyse the terms for the penalties, missed payment costs and early repayment payouts. If confused, check whether the loan provider offers early repayment. Don’t pay if he doesn’t.

Step 6- Carry payments according to agreement

Lastly, make payments according to the schedule mentioned in the agreement. You can even set direct debits if you hold one such account. You may benefit from this on interest terms. Moreover, it allows you to repay the dues without setting reminders. You just need to ensure the amount is higher than the monthly repayment in the account. It will help the direct debit work rightly.

Bottom line

A doorstep loan is a facility to get cash at your doors in no time. It helps you meet any urgent need without the need to walk outside the house. You may even get the money online if you hold an online banking facility or a valid bank account. The lender’s representative provides funds at your doorstep within 35-40 minutes. You can use it for any small purpose.

Jessica Rodz is the Senior Content Writer at Cashfacts. She has a long career in the field of content writing and editing. Jessica has the expertise in the UK lending marketplace where she has worked with 7 different lending organisations and acquired many responsibilities from preparing loan deals and writing blogs for their websites.

At Cashfacts, Jessica is managing a team of experienced loan experts and doing a major contribution in guiding the loan seekers via well-researched blogs. She has done graduation in Business (Finance) and now currently doing research papers on the UK financial sector.